How is the market in 2023?

by John Engel

Sept 8, 2023

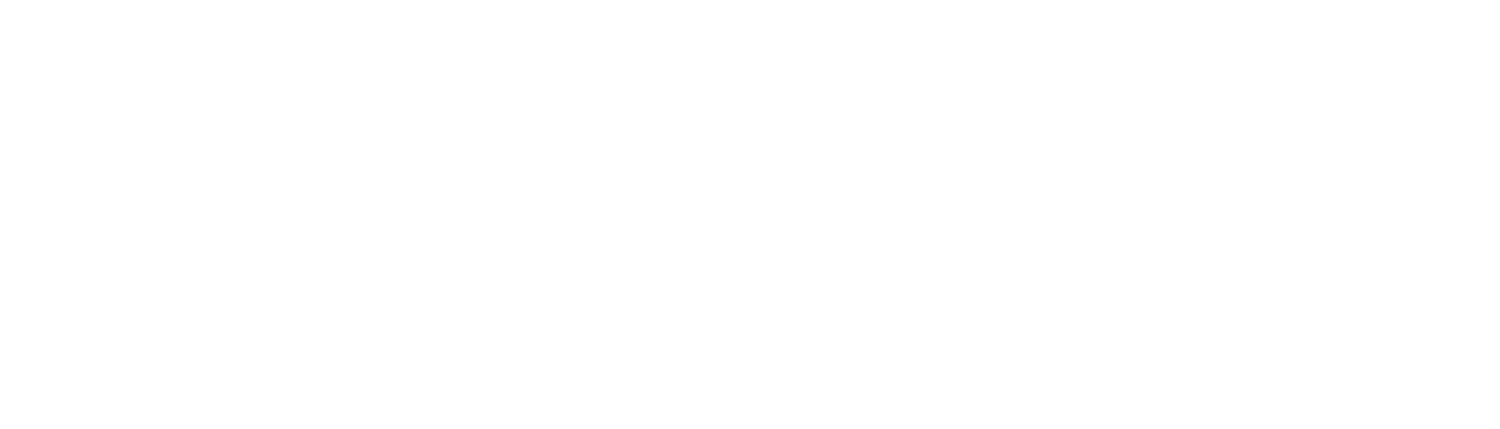

New Canaan Inventory By Property Type, 2014-2023

The standout story for 2023 revolves around the glaring lack of inventory. This scarcity significantly impacts the price and transaction volume in the New Canaan real estate market. The inventory shortage has overshadowed the effects of rising interest rates and inflation. Every experienced agent in New Canaan can point to potential sellers who hesitate to list their homes until they secure their next purchase. Consider these six recent scenarios:

A New Canaan family acquired a waterfront property in Darien and plans to list their existing home.

Due to a job transfer, another family contemplates renting out their New Canaan house during their three-year stint overseas.

A North Stamford family, with children having left, thinks of downsizing and possibly moving to Hilton Head next spring.

A New Canaan family, now without children, wishes to downsize from 8,000 sq.ft. to 4,000 sq.ft. They struggle to find a sizable, luxury condo in Connecticut that meets their criteria and have no plans to list their house.

A young family, daunted by the escalating costs of expansion and renovation, decided to buy a larger home in New Canaan and list their current one afterward.

After a promotion, a husband faces a daily commute. The couple pondered buying closer to NYC and possibly renting out their New Canaan residence. However, they abandoned the idea due to a fruitless search.

Many potential sellers prefer to locate their next home before listing their current property, believing that market demand will persist and guarantee a fair sale when they're ready. Some sellers anticipate a decrease in interest rates by 2025, but the majority are holding out for the perfect home.

Fairfield County Residential Months of Supply from 2004 to 2023

Categories of Sellers

Sellers typically fit into one of the following categories: "Cashing Out," "Rightsizing," "Trading Up," or "Moving/Geographic." In my view, a combination of low prices and interest rates lured more "Trading-Up" sellers. The surge in remote work attracted more sellers pursuing job opportunities, particularly as many finance professionals migrated to Florida. As interest rates shot up to over 7% in the past 18 months, the "Cashing Out" group felt the pinch. These sellers often show heightened price sensitivity and might delay listing until they spot a more enticing buying opportunity. Meanwhile, the "Moving" category encompasses individuals relocating for job prospects or familial reasons. Unlike the "Cashing Out" group, these "Movers" have clear destinations in mind and face self-imposed timelines. Data from 2023 indicates a strong presence of "Trading Up" and "Moving" buyers, many of whom are cash-rich and determined to secure their desired properties.

Fairfield County Listing Inventory 2018 to 2023

Uneven demand

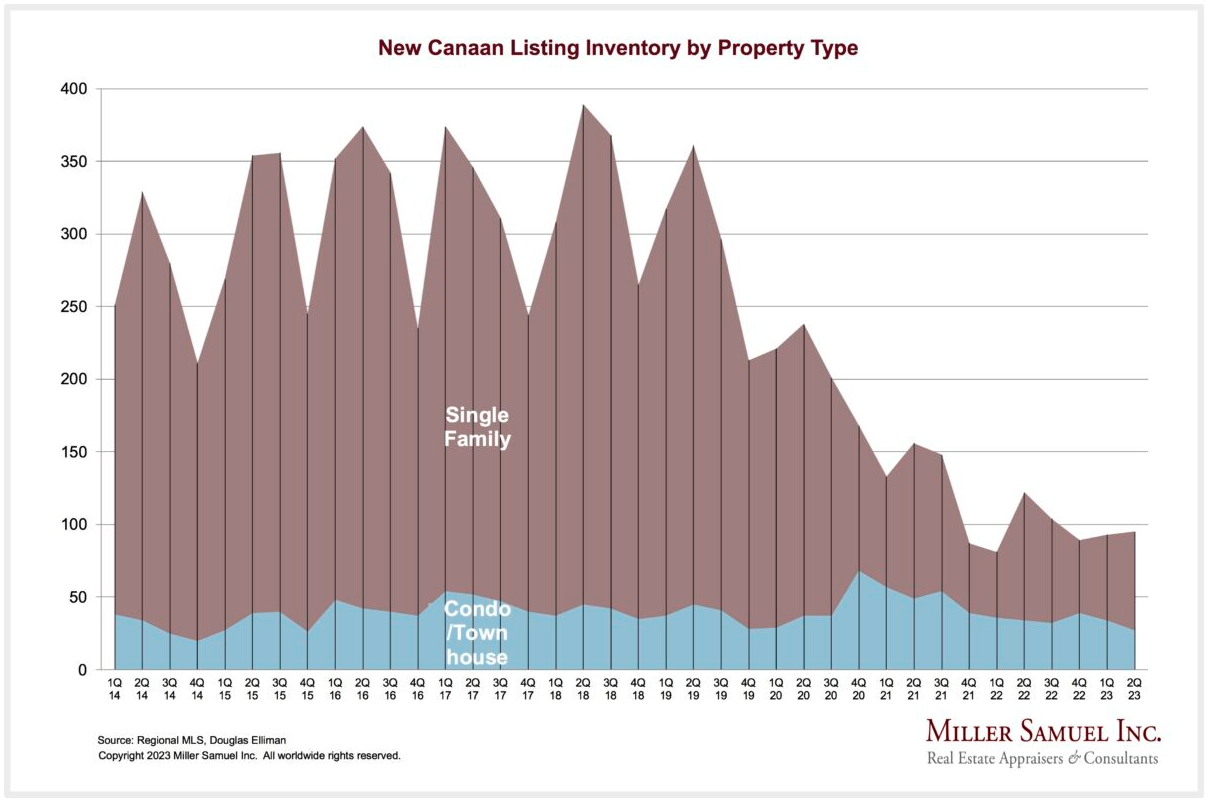

Historically, some market segments saw virtually no buyers; a price drop might elicit no response from the market. That is not the case today. In 2023, despite transactions decreasing due to low inventory, individual listings show robust activity. For example, a listing of mine that's been on the market for over a year has 1,629 views and 88 saves on Zillow this month. This might indicate either a pricing or presentation problem. In this case it’s a complicated property with many buildings and needs work. Properties that need work are a special category of the market for which there is significantly less demand. Appraiser Jonathan Miller noted that sellers often lag 6 to 12 months in adapting to the market, coining 2023 as "the year of disappointment." Sellers won’t get their 2021 price. Buyers won’t see a substantial savings in pricing. Prices aren’t going to correct.

Fairfield County Market Share of Sales Over List Price 2017 to 2023

What is normal inventory?

The old adage suggests 5-6 months of inventory indicates a balanced market. However, pre-pandemic figures for New Canaan fluctuated between 8 to 20 months. As of now, New Canaan has 3.7 months of supply, an increase of 8.8% since August 2022. Neighboring towns are closer to a 2.0-month supply, down 13% since this time last year.

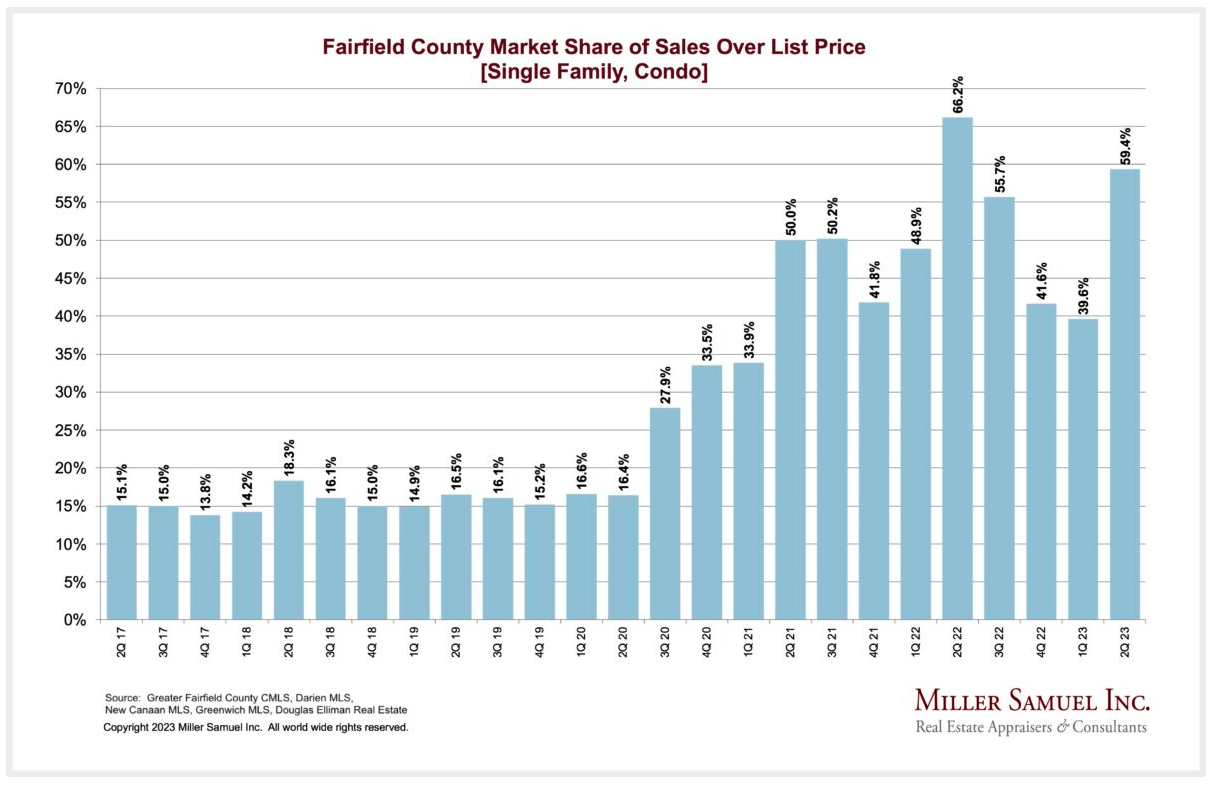

Migration by County, showing that Connecticut is Leaving for Florida and Massachusetts, but gaining from New York

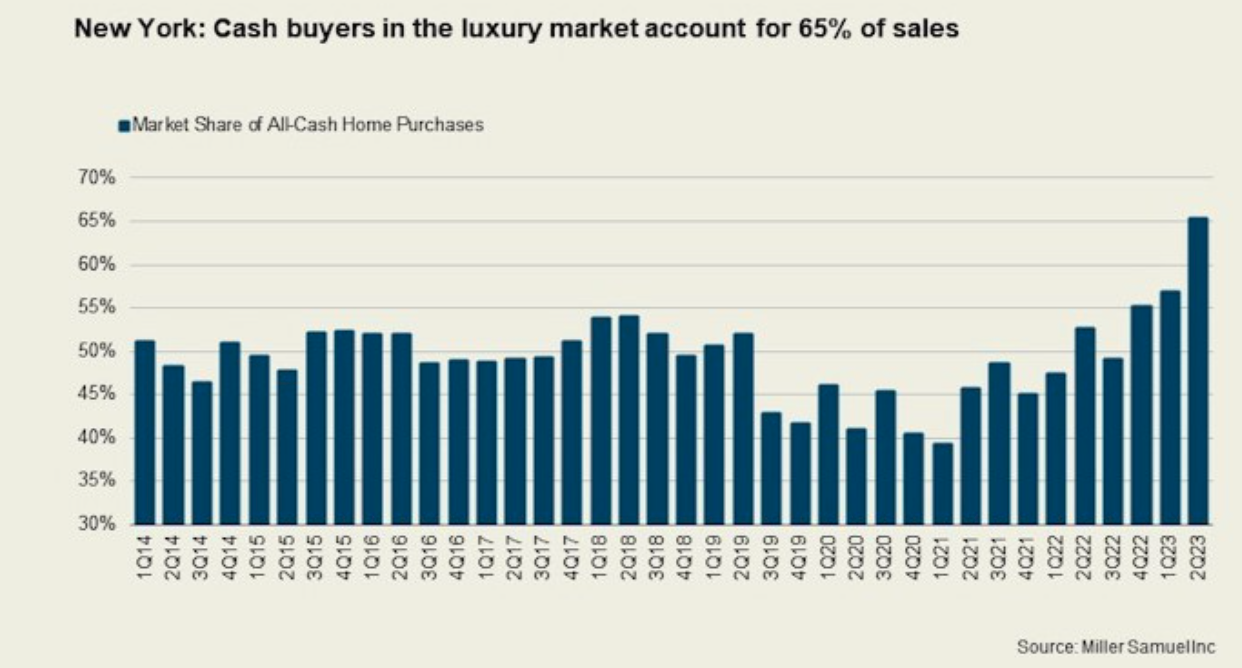

Does cash matter?

Last year one-third of homes were cash purchases. In Manhattan's Q2, an unprecedented 65% of transactions were cash-based. As transactions slowed, cash buyers fell by about 20% and financed buyers fell 50%. Today’s market strength is relying disproportionately on cash buyers, and because cash buyers typically skew higher, this is one of the reasons we are seeing strength at the high end of the market in New Canaan.

Cash Buyers in the Luxury Market Account for 65% of Sales

What is the profile of the cash buyer?

Retirees, relocated families, foreign investors, and high-net-worth individuals form the bulk of cash buyers. A significant statistic is that over half of cash buyers nationally are Baby Boomers, aged between 58 to 76.

Where are New Canaan’s buyers coming from?

They’re still coming from New York, and still leaving for Florida. According to Bloomberg, New York City's population dipped by 500,000 in the last three years. In contrast, in 2020, 38,029 individuals relocated from New York to Connecticut. In 2021 Connecticut gained 19,000 but in 2022 we lost another 13,547. The state grew by only 2,850 in 2022, a gain of only .08%. In New Canaan there is no population increase. Increased demand results in price increases and more permits.

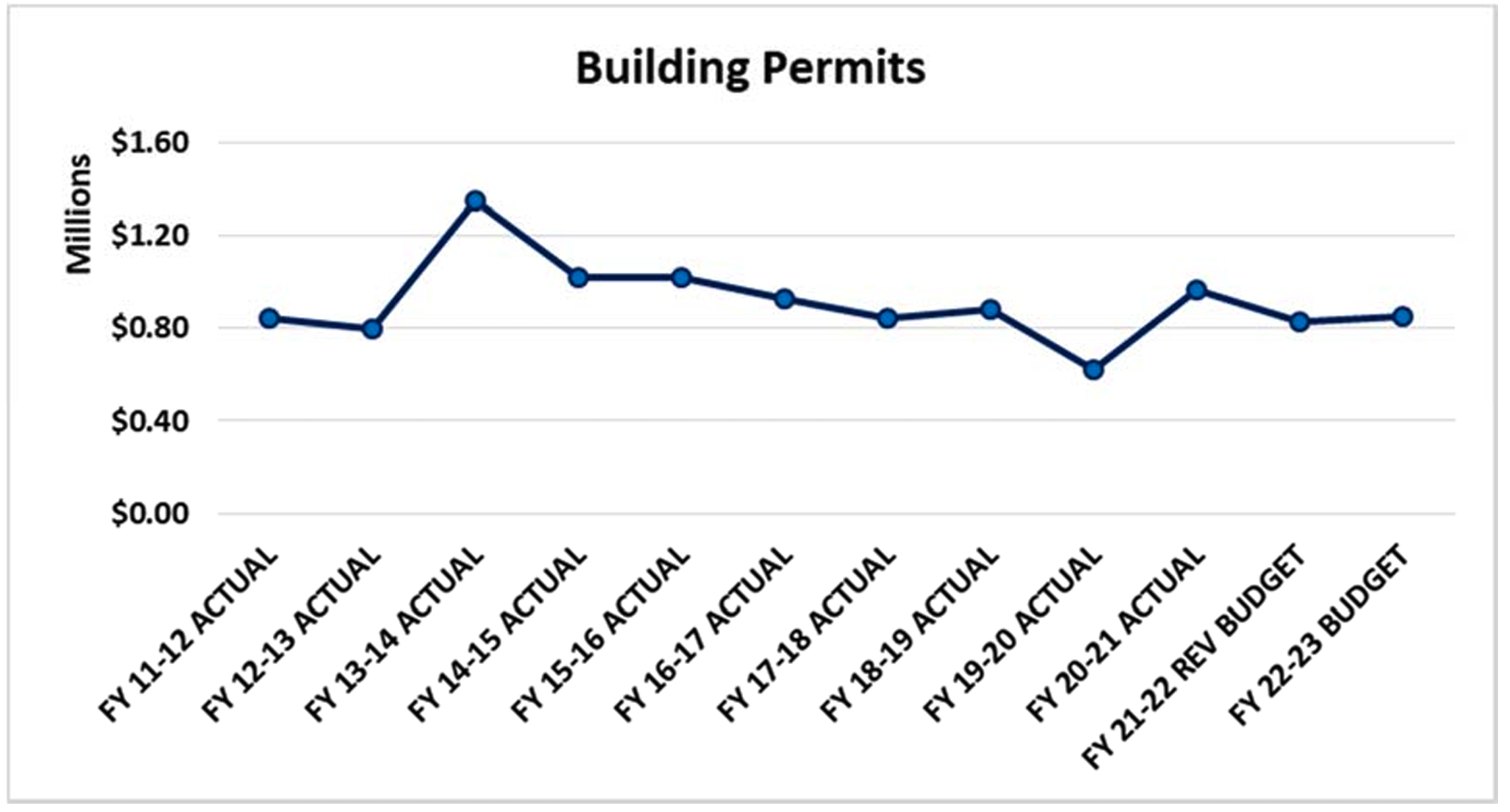

New Canaan Building Permits Budget Over the Last 10 Years does not Reflect the Increase in Permit Activity. source: New Canaan Building Department Budget Book 22-23

Is New Canaan Building New Houses?

One way to measure the amount of new building and expansion is to look at building permit activity. Although building permit revenue in New Canaan appears steady, there's more activity than the budget suggests. I called the head of New Canaan’s building department, Brian Platz and asked him what he’s seeing. He said that the budget does not reflect the increase in building activity that is taking place. He said that last year the building department met their budget goals 5 months early. In 2019 he processed an estimated 1,487 permits worth $55,550,278. In 2020 that number jumped to 2549 permits worth $101,674,417. In 2021 permits dropped to 1,947 but value rose, $130,648,896. This year, FY22-23 we are back up to 2,062 permits worth $80,157,566. The conclusion: after peaking at 235% of normal New Canaan is still 44% above pre-pandemic levels. Brian said that in a typical year we will see permits for 40 to 50 new houses in New Canaan, and maybe 70 in a record year. This year we are building at a level of about 30 houses. Is it a question of too few teardowns for developers to buy? While interest rates are a factor he thinks the current cost of lumber, labor, copper and Pex are having an effect. Most of the increase in permits are for kitchens and baths as people prepare their houses for sale, and from the new owners who want to make additional changes.

New Canaan Listing Inventory 2018-2023

Conclusions this week are that we are in a seller’s market driven by a lack of inventory, but that sellers are differently motivated and some more influenced by inventory levels than others. Despite the explosion of building permits we are not seeing an increase in house construction, exacerbating our supply problem. While inventory remains a concern, the robust activity around individual listings underscores the demand strength. The rise in cash transactions, predominantly from diverse buyer profiles, showcases the evolving nature of market participants. Even as external factors like interest rates and material costs fluctuate, New Canaan's construction activity remains resilient. Overall, the data highlights a market in flux, with opportunities and challenges coexisting in this ever-evolving real estate landscape.

Check out John Engel’s Podcast, Boroughs & Burbs, the National Real Estate Conversation here.