Manhattan Market Report

Manhattan first quarter sales fell, down 11.3% annually, now below two thousand (1,988), the lowest level in 3 years. Prices slid year-over-year, now 17.4% below pre-pandemic levels. Inventory went lower due to the “lock-in-effect”. Mortgage-purchases dropped 26.7% annually. The percentage of cash sales has reached a record high, up each of the last 2 quarters and now up 1.5% more than a year ago. 40% of resales in the first quarter saw price cuts, an increase over the previous year. One bright spot is the Luxury Market, defined as the top 10% of all sales. Luxury median sale price rose year-over-year for the fourth straight quarter. Luxury inventory increased for the first time in four quarters. Luxury entry threshold fell for the first time in four quarters.

Property Taxes Are Going Up

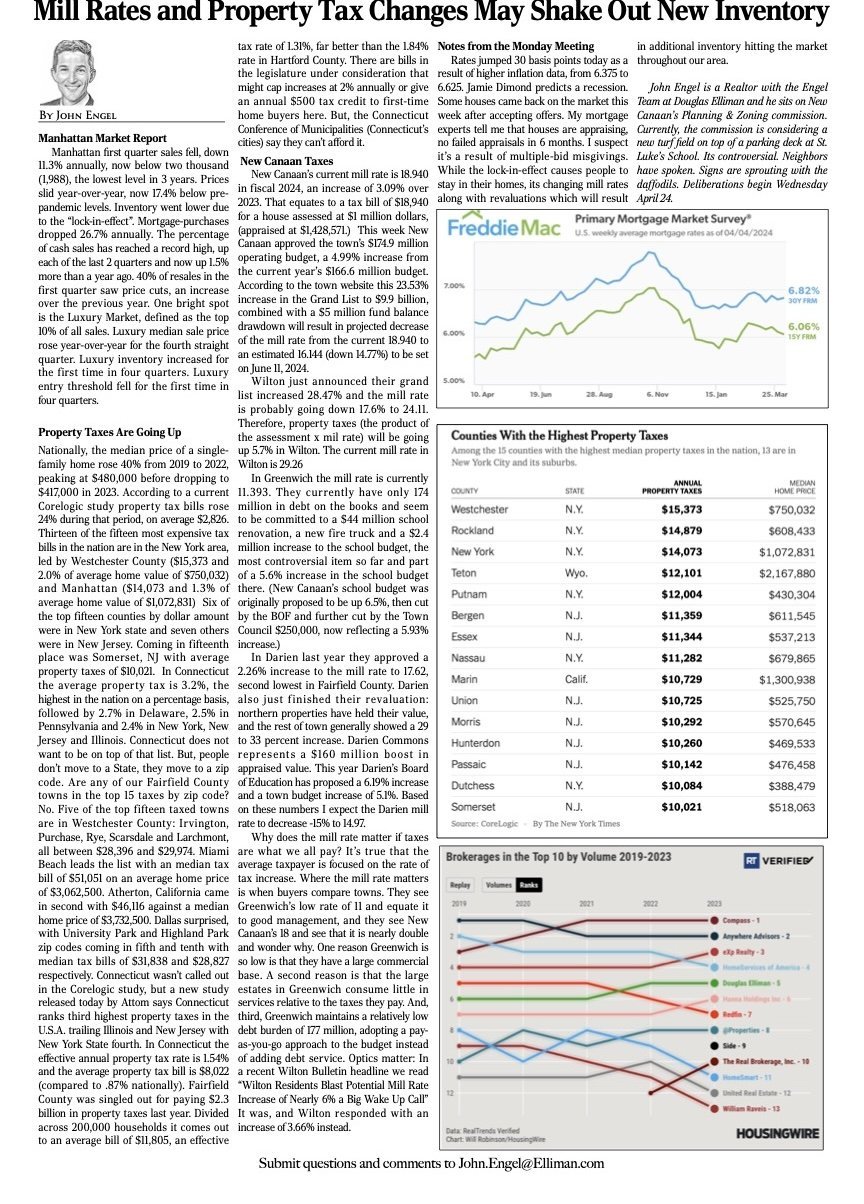

Nationally, the median price of a single-family home rose 40% from 2019 to 2022 peaking at $480,000 before dropping to $417,000 in 2023. According to a current Corelogic study property tax bills rose 24% during that period, on average $2,826. Thirteen of the fifteen most expensive tax bills in the nation are in the New York area, led by Westchester County ($15,373 and 2.0% of average home value of $750,032) and Manhattan ($14,073 and 1.3% of average home value of $1,072,831) Six of the top fifteen counties by dollar amount were in New York state and seven others were in New Jersey. Coming in fifteenth place was Somerset, NJ with average property taxes of $10,021. In Connecticut the average property tax is 3.2%, the highest in the nation on a percentage basis, followed by 2.7% in Delaware, 2.5% in Pennsylvania and 2.4% in New York, New Jersey and Illinois. Connecticut does not want to be on top of that list. But, people don’t move to a State, they move to a zip code. Are any of our Fairfield County towns in the top 15 taxes by zip code? No. Five of the top fifteen taxed towns are in Westchester County: Irvington, Purchase, Rye, Scarsdale and Larchmont, all between $28,396 and $29,974. Miami Beach leads the list with an median tax bill of $51,051 on an average home price of $3,062,500. Atherton, California came in second with $46,116 against a median home price of $3,732,500. Dallas surprised, with University Park and Highland Park zip codes coming in fifth and tenth with median tax bills of $31,838 and $28,827 respectively. Connecticut wasn’t called out in the Corelogic study, but a new study released today by Attom says Connecticut ranks third highest property taxes in the U.S.A. trailing Illinois and New Jersey with New York State fourth. In Connecticut the effective annual property tax rate is 1.54%

and the average property tax bill is $8,022 (compared to .87% nationally). Fairfield County was singled out for paying $2.3 billion in property taxes last year. Divided across 200,000 households it comes out to an average bill of $11,805, an effective tax rate of 1.31%, far better than the 1.84% rate in Hartford County. There are bills in

the legislature under consideration that might cap increases at 2% annually or give an annual $500 tax credit to first-time home buyers here. But, the Connecticut Conference of Municipalities (Connecticut’s cities) say they can’t afford it.

New Canaan Taxes

New Canaan’s current mill rate is 18.940 in fiscal 2024, an increase of 3.09% over 2023. That equates to a tax bill of $18,940 for a house assessed at $1 million dollars, (appraised at $1,428,571.) This week New Canaan approved the town’s $174.9 million operating budget, a 4.99% increase from the current year’s $166.6 million budget. According to the town website this 23.53% increase in the Grand List to $9.9 billion, combined with a $5 million fund balance drawdown will result in projected decrease of the mill rate from the current 18.940 to an estimated 16.144 (down 14.77%) to be set on June 11, 2024. Wilton just announced their grand list increased 28.47% and the mill rate is probably going down 17.6% to 24.11. Therefore, property taxes (the product of the assessment x mil rate) will be going up 5.7% in Wilton. The current mill rate in Wilton is 29.26 In Greenwich the mill rate is currently 11.393. They currently have only 174 million in debt on the books and seem to be committed to a $44 million school renovation, a new fire truck and a $2.4 million increase to the school budget, the most controversial item so far and part of a 5.6% increase in the school budget there. (New Canaan’s school budget was originally proposed to be up 6.5%, then cut by the BOF and further cut by the Town Council $250,000, now reflecting a 5.93% increase.) In Darien last year they approved a 2.26% increase to the mill rate to 17.62, second lowest in Fairfield County. Darien also just f inished their revaluation: northern properties have held their value, and the rest of town generally showed a 29 to 33 percent increase. Darien Commons represents a $160 million boost in appraised value. This year Darien’s Board of Education has proposed a 6.19% increase and a town budget increase of 5.1%. Based on these numbers I expect the Darien mill rate to decrease -15% to 14.97. Why does the mill rate matter if taxes are what we all pay? It’s true that the average taxpayer is focused on the rate of tax increase. Where the mill rate matters is when buyers compare towns. They see Greenwich’s low rate of 11 and equate it to good management, and they see New Canaan’s 18 and see that it is nearly double and wonder why. One reason Greenwich is so low is that they have a large commercial base. A second reason is that the large estates in Greenwich consume little in services relative to the taxes they pay. And, third, Greenwich maintains a relatively low debt burden of 177 million, adopting a pay-as-you-go approach to the budget instead of adding debt service. Optics matter: In a recent Wilton Bulletin headline we read “Wilton Residents Blast Potential Mill Rate Increase of Nearly 6% a Big Wake Up Call” It was, and Wilton responded with an increase of 3.66% instead.

Notes from the Monday Meeting

Rates jumped 30 basis points today as a result of higher inflation data, from 6.375 to 6.625. Jamie Dimond predicts a recession. Some houses came back on the market this week after accepting offers. My mortgage experts tell me that houses are appraising, no failed appraisals in 6 months. I suspect it’s a result of multiple-bid misgivings. While the lock-in-effect causes people to stay in their homes, its changing mill rates along with revaluations which will result in additional inventory hitting the market throughout our area.

John Engel is a Realtor with the Engel Team at Douglas Elliman and he sits on New Canaan’s Planning & Zoning commission. Currently, the commission is considering a new turf field on top of a parking deck at St. Luke’s School. Its controversial. Neighbors have spoken. Signs are sprouting with the daffodils. Deliberations begin Wednesday April 24.

Check out John Engel’s Podcast, Boroughs & Burbs, the National Real Estate Conversation here.