Many of us are wondering how long it will take until the pendulum swings. How long before the seller’s market becomes a buyer’s market? There are many factors at play, but the favorite term being bandied about on talk shows and cocktail parties is “Lock-in effect”. This is the measure of how constrained people are to make appropriate financial changes, especially moving, but can be applied to diverse activities such as selling stocks, changing jobs, or inheriting wealth. Lock-in effect is a friction in the financial system. I explained in a previous column that the average American stays a lot longer in their home, 13 years on average, up from 5 years, and interest rate changes are only one factor.

The Federal Housing Finance Agency (FHFA) regulates Fannie Mae and Freddie Mac. They looked at 14.3 million loans and published a study this week that explains the relationship between rising mortgage rates, decreasing inventory levels, and rising housing prices. It’s called the “Lock-In Effect.” They estimate that the lock-in effect decreased the sales of homes with fixed-rate mortgages by 57% in 2023Q4 and prevented 1.33 million sales between 2022Q2 and the end of 2023. They tested several possible scenarios and found that the reduction in sales is unlikely to dissipate quickly. They estimated that during this period lock-in-related supply reduction increased home prices by 5.7% while the direct effect of elevated rates decreased them by 3.3%.

Let’s compare these to New Canaan year- end results. For houses, the median sale price rose 3.9% and the average rose 2.5%. According to the study, the lack of supply brought our median from $1.925 million to $2.035 million, but rising interest rates brought it down to $2.00 million.

For condos the median rose 4.5% and the average rose 3.9%. I believe condo prices rose more than houses because 15 of the 68 condo sales were new units averaging $1.92 million compared to $1.04 million for older units. Annual condo sales volume is currently higher than any point in the 20 years before the pandemic, even when excluding the 15 sales of newly-built units.

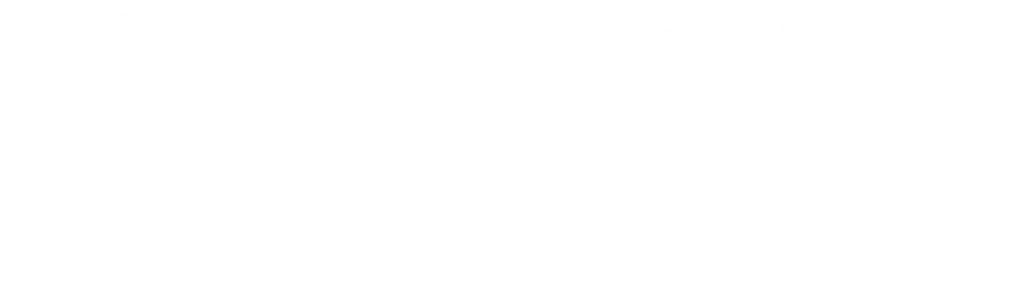

In Figure 3 of the FHFA’s study we see the rate delta over the last 30 years. Note that in most years the vast majority of us have a fixed-rate mortgages within 2 points of current mortgage levels (BLUE + PURPLE + GREEN + YELLOW). Currently 60% of us have a rate more than 2 points lower than current rates (RED), and another 20% of us have a rate more than 3 percent below current rates (ORANGE). We have not experienced these conditions in the last 30 years.

This study quantifies the Lock-In Effect describing interest rates effect on only two variables affecting house prices here: a lack of supply caused by lock-in leads to rising prices and rising rates leading to reduced prices. What about the other factors affecting prices in our neighborhood? Here is my list of 9 more:

1. Jobs – the health and prospects for the NYC and Connecticut economies have a direct effect on house prices.

2. Wages – currently home prices and home expenses are outpacing wage growth, both nationally and in this area.

3. Inflation – particularly the cost of construction is having an effect on prices. Builders say prices have not caught up to where they need to be to start building after experiencing record residential construction inflation of 14% in 2021 and 15.7% in 2022. Potential sellers are weighing the cost of renovating versus buying. I know of two residents who walked away from planned expansions because it was cheaper to buy existing construction.

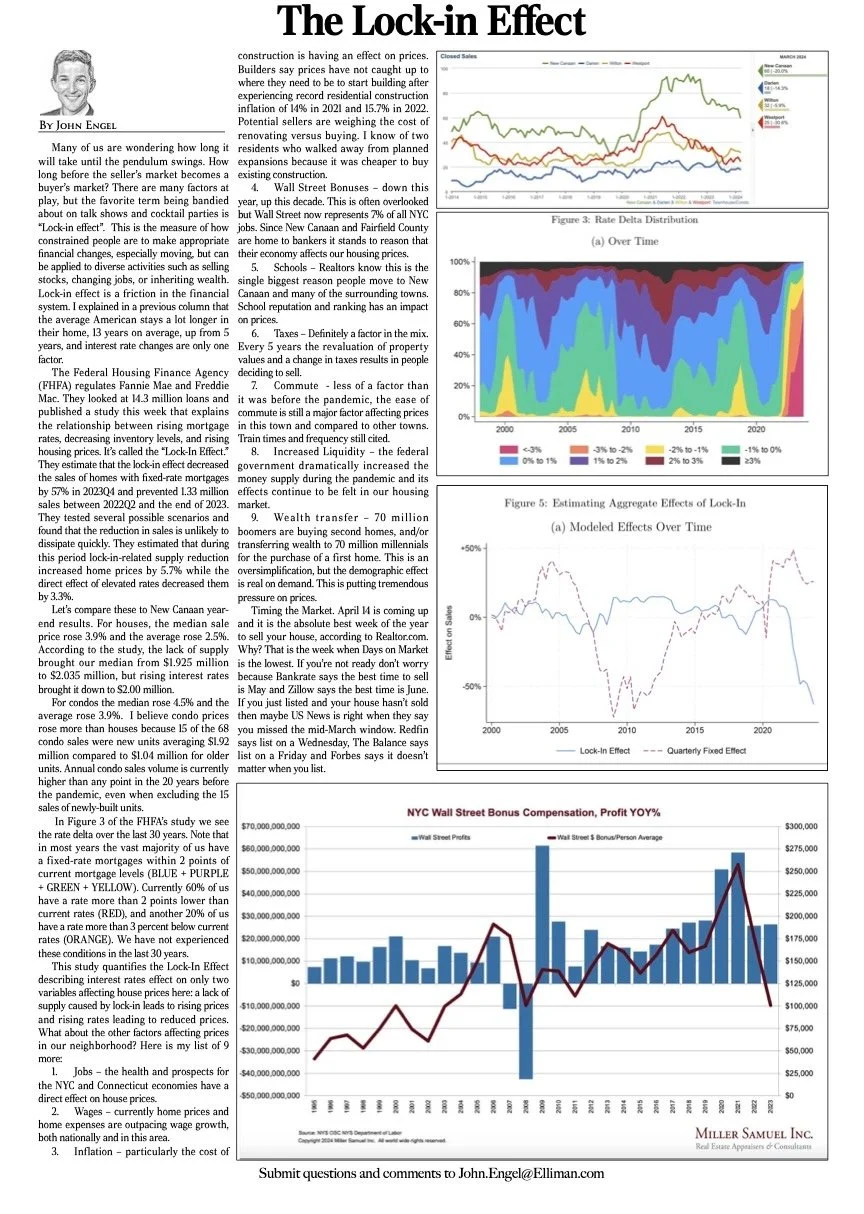

4. Wall Street Bonuses – down this year, up this decade. This is often overlooked but Wall Street now represents 7% of all NYC jobs. Since New Canaan and Fairfield County are home to bankers it stands to reason that their economy affects our housing prices.

5. Schools – Realtors know this is the single biggest reason people move to New Canaan and many of the surrounding towns. School reputation and ranking has an impact on prices.

6. Taxes – Definitely a factor in the mix. Every 5 years the revaluation of property values and a change in taxes results in people deciding to sell.

7. Commute – less of a factor than it was before the pandemic, the ease of commute is still a major factor affecting prices in this town and compared to other towns. Train times and frequency still cited.

8. Increased Liquidity – the federal government dramatically increased the money supply during the pandemic and its effects continue to be felt in our housing market.

9. Wealth transfer – 70 million boomers are buying second homes, and/or transferring wealth to 70 million millennials for the purchase of a first home. This is an oversimplification, but the demographic effect is real on demand. This is putting tremendous pressure on prices.

Timing the Market. April 14 is coming up and it is the absolute best week of the year to sell your house, according to Realtor.com. Why? That is the week when Days on Market is the lowest. If you’re not ready don’t worry because Bankrate says the best time to sell is May and Zillow says the best time is June. If you just listed and your house hasn’t sold then maybe US News is right when they say you missed the mid-March window. Redfin says list on a Wednesday, The Balance says list on a Friday and Forbes says it doesn’t matter when you list.

Check out John Engel’s Podcast, Boroughs & Burbs, the National Real Estate Conversation here.